Strong private home sales, prices point to stabilising property market

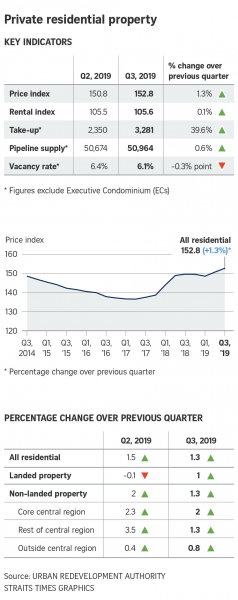

Private home prices also rose in tandem, climbing 1.3 per cent in the third quarter of this year, compared with the previous three months.

Defying global uncertainties and a slowing economy, Singapore’s private property market showed it was in good health, with the highest number of new homes being sold in a single quarter in more than six years.

Private home prices also rose in tandem, climbing 1.3 per cent in the third quarter of this year, compared with the previous three months.

The trend was underpinned by strong pent-up demand from both local and foreign buyers, analysts said, showing that the private property market had come to terms with the July 2018 cooling measures. At the same time, there seemed to be little risk of a housing bubble forming as the prices were rising at a moderate pace.

Prices have risen by a cumulative 2.1 per cent in the first nine months of this year. Landed property prices climbed 1 per cent in the third quarter, compared with a 0.1 per cent dip in the previous quarter.

Developers sold 3,281 homes in the third quarter, up 39.6 per cent from 2,350 units booked in the previous quarter.

More significantly, this was the highest number of new private homes sold in a single quarter since the second quarter of 2013.

In June 2013, measures were put in place to stop a housing bubble from forming, including caps on the debt individuals could service relative to their income. This was to put a lid on speculation and to stop buyers from overstretching themselves.

There was also a sharp spike of more than 50 per cent in the number of Singaporeans buying new launch units to 2,687 in the third quarter, from 1,772 in the second quarter, said Huttons Asia director of research Lee Sze Teck. One reason could be that Singapore property is seen as a more stable asset than other forms of investment, given the uncertainty gripping global stock markets, for example.

It was not just Singapore buyers who seemed to share this sentiment. The number of foreign buyers purchasing units in new launches jumped 77 per cent in the third quarter to 232, from 131 in the second quarter, and up 56 per cent from 149 in the third quarter of last year, Mr Lee noted.

Ms Tricia Song, head of research for Singapore at Colliers International, said the foreigners buying properties here were possibly attracted by the stable Singdollar and Singapore’s safe haven status amid global volatility.

Ms Christine Sun, head of research and consultancy at OrangeTee & Tie, said while both sales and prices were healthy, there was no need to implement more cooling measures in the near term.

“The risk of a housing bubble forming is rather remote as this usually (involves) a significant run-up in home prices caused by high speculative demand, runaway land prices and excessive buying that is fuelled by exuberant spending,” she said.

Ms Sun pointed out that the cumulative price growth for the first three quarters this year of 2.1 per cent is much slower than the 7.9 per cent increase over the same period last year.

This trend of moderate price growth and healthy private home sales is likely to continue, even as more new projects are launched at relatively high prices per sq ft, analysts said.

A total of 11 projects were launched in the third quarter. CBRE expects close to 15 more new launches next quarter. At the same time, there is an unsold inventory of 31,948 units (excluding executive condominiums), which could act as a check on rising prices.

“Underlying demand will still support the property market until unsold inventory piles up,” said Mr Desmond Sim, CBRE’s head of research for South-east Asia.

A version of this article appeared in the print edition of The Straits Times on October 26, 2019, with the headline ‘Strong sales, prices point to stabilising property market’. Print Edition | Subscribe

Source